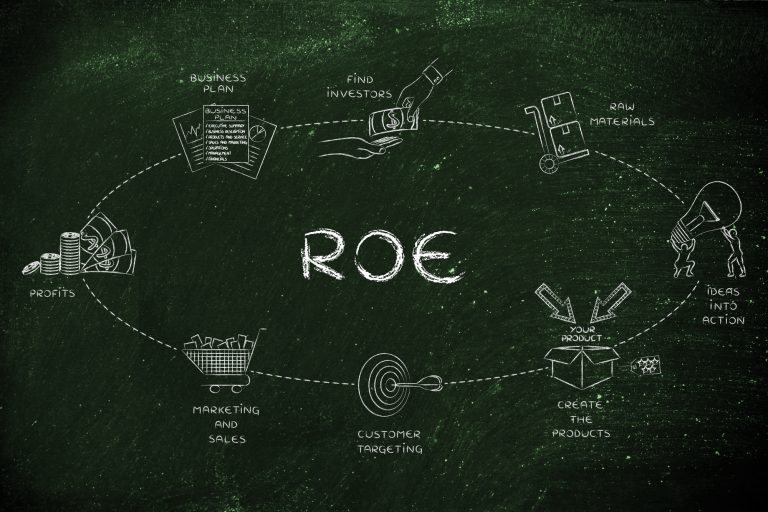

Return on Assets (ROA): This calculation measures a company's net income as a percentage of its average total assets.Ĥ. Gross Margin ROE: This calculation measures a company's gross margin (sales revenue minus the cost of goods sold, divided by sales revenue) as a percentage of its average equity.ģ. Operating ROE: This calculation measures a company's operating income (net income before interest and taxes) as a percentage of its average equity.Ģ. Essentially, it shows how efficiently a company is using its equity to generate profits. There are many different types of return on equity (ROE) calculations, but in general, ROE measures a company's profitability by comparing its net income to its shareholder equity. What are Some Examples of Return on Equity? This is important to shareholders because it means that they are earning a good rate of return on their investment. A high ROE indicates that a company is generating a high rate of return on its invested capital. ROE can be used to compare the profitability of companies with different levels of debt and equity. It is calculated by dividing a company's net income by its shareholders' equity. Return on Equity (ROE) is a measure of a company's profitability that takes into account the company's equity capital. ROA is a better indicator of how well a company is using its assets to generate profits. For example, a company with a lot of debt but no profits will have a high ROA, even though it is not a very profitable company.įinally, ROE is a better indicator of how well a company is using its equity to generate profits. ROA does not adjust for the use of debt, which can distort the measure. ROE is also a more accurate measure of a company’s profitability than ROA, as it adjusts for the use of debt. ROA, on the other hand, does not take into account a company’s debt levels. This is because debt holders have a higher claim on a company’s assets in the event of bankruptcy than equity holders. The higher the debt levels, the higher the ROE will be, as long as the company is still profitable. ROE takes into account the amount of debt a company has on its balance sheet. To calculate ROA, we divide net income by the average total assets. In order to calculate ROE, we divide net income by the average shareholders’ equity.

The most fundamental difference between Return on Equity (ROE) and Return on Assets (ROA) is that ROE measures the profitability of the owners’ investment in the company, while ROA measures the profitability of all the company’s invested capital. What is the Difference Between Return on Equity and Return on Assets? A company with a higher ROE than its competitors is likely doing a better job of using its shareholders' money to generate profits. ROE can be a useful tool for comparing different companies in the same industry. A company that is able to generate more revenue with the same amount of expenses will have a higher ROE. However, a company with a lot of debt is also more risky, so its stock prices may be more volatile.Īnother thing that can affect a company's ROE is its level of operating efficiency. A company with a lot of debt will have a higher ROE because its profits will be higher after interest payments are made.

There are a few things that can affect a company's ROE. A higher ROE means that a company is more efficient at generating profits with its shareholders' money. ROE is a measure of how efficiently a company is using its shareholders' money to generate profits. Shareholders' equity is calculated by taking a company's total assets and subtracting its total liabilities. Net income is calculated by taking a company's total revenue and subtracting its total expenses. In order to calculate a company's return on equity (ROE), you need to take its net income and divide it by its shareholders' equity. Investors typically prefer companies with high ROEs because they believe the company will be able to generate more profits in the future. The higher the ROE, the more efficient the company is at generating profits with the money it has. ROE is important because it gives investors a snapshot of how efficiently a company is using its capital. It is calculated by dividing net income by shareholders' equity. Return on Equity (ROE) is a measure of a company's profitability that calculates how much profit a company generates with the shareholders' equity it has.

0 kommentar(er)

0 kommentar(er)