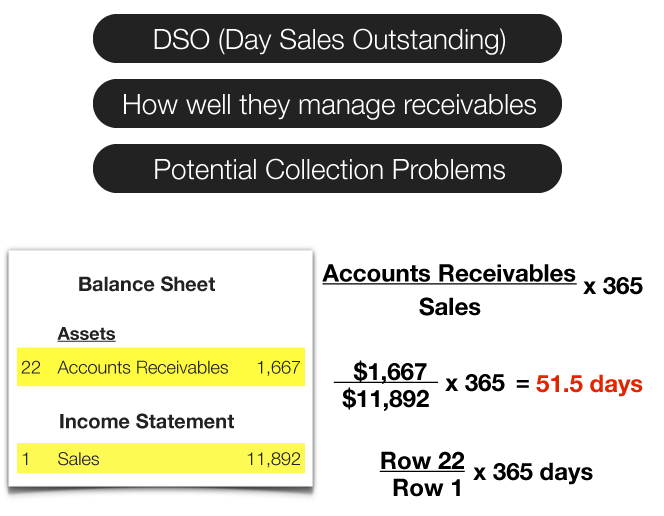

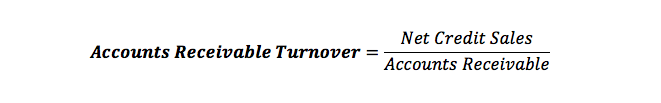

John, a junior accountant at a food company, has been requested by his seniors to compute the accounts receivable turnover ratio for year just ended. Let us see how this formula works in an example. To this end, one computes the sum of the beginning accounts receivable and the ending accounts receivable and then divide by two.Īccounts Receivable Turnover Ratio Example On the other hand, there is the average of accounts receivable for the period in consideration. If the period under consideration is one financial year, then the accountant will put together the net sales for which the customers have not paid in yet during that year. The two main components used in computing accounts receivable ratio are net credit sales for the period in consideration. Also, this ratio informs a business of where it stands relative to competitors in the industry.Īccounts Receivable Turnover Ratio Formula For example, the ratio for the just ended financial year may be compared to the previous year to gauge where the business stands in terms of revenue collection efficiency.

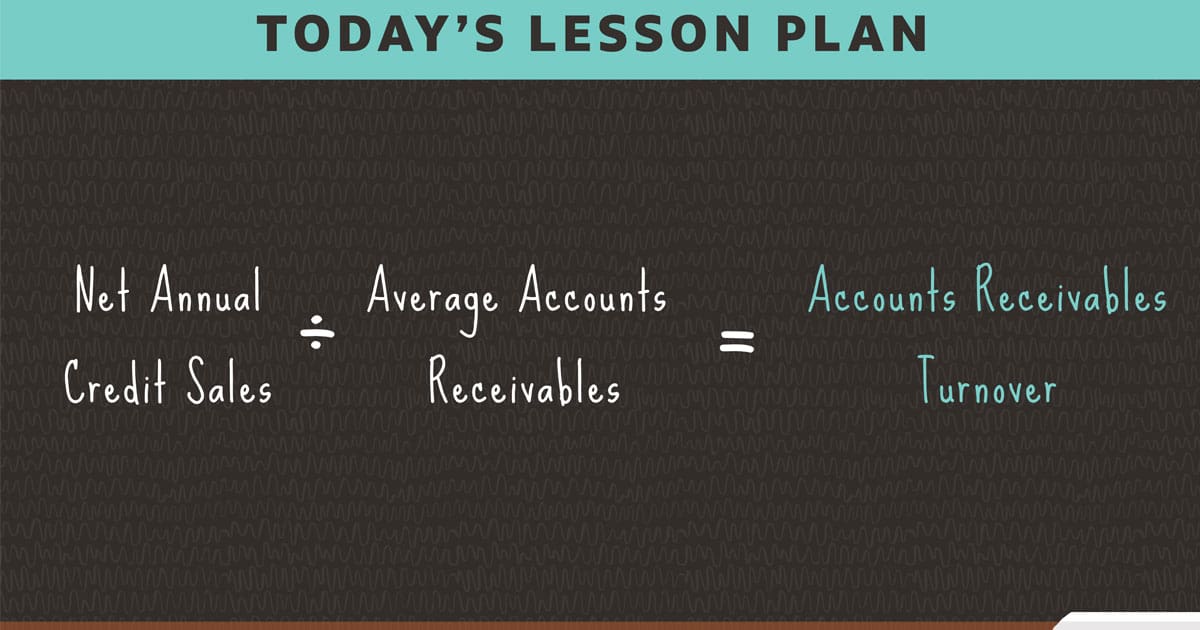

Typically, the receivable turnover ratio enables businesses to keep track of their performance over the years. This is because unadjusted total credit sales lead to inflated readings. If the gross credit sales are used, the business is likely to come up with a wrong result. Important to note, businesses use the net credit sales to compute the receivable turnover ratio. Also known as debtor’s turnover ratio, the accounting metric displays the businesses’ efficiency when it comes to using assets. This ratio tells stakeholders how quickly a business can convert credit extended to customers into cash. What is the Accounts Receivable Turnover Ratio?ĭefinition: The accounts receivable turnover ratio is an accounting measure that quantifies how effective a company is, at collecting receivables from clients.

0 kommentar(er)

0 kommentar(er)